Managing a sales ledger effectively is crucial for small and medium-sized enterprises (SMEs) in the UK. Not just for keeping track of sales and receipts, but ensuring your business stays financially healthy and cash flow remains steady.

To help you manage your sales ledger more successfully, we have compiled five straightforward tips. Let’s get straight to them.

1. Stay Organised

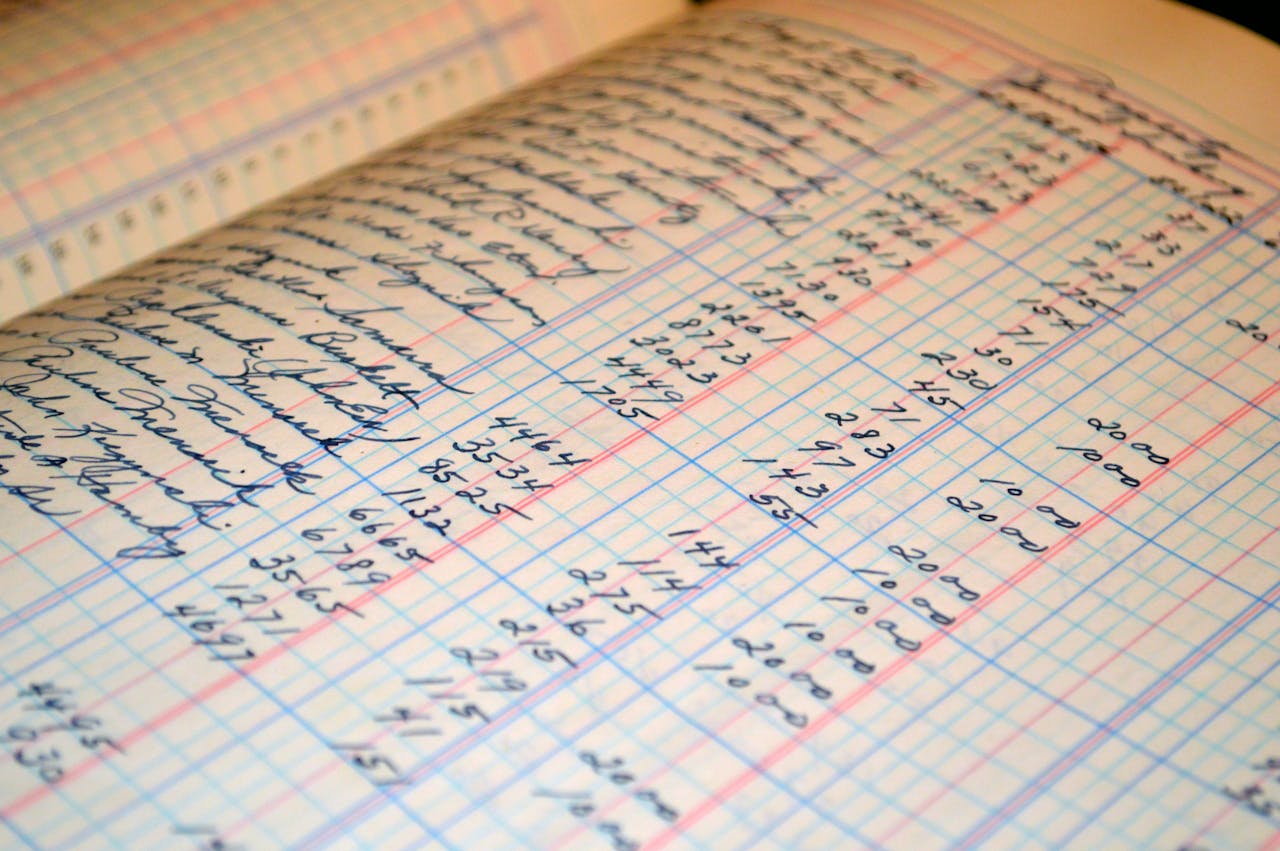

The first tip is all about staying organised. Use a system that suits your business to keep all invoices and receipts organised, whether that's digital or paper.

87% of businesses face late payments, partly due to disorganized receivables processes. By using digital tools and accounting software, businesses can reduce the time spent on managing accounts receivable tasks by up to 56%, leading to quicker payment processing and reduced time chasing late payments.

Consider adopting accounting software, which can automate many processes such as invoice generation, tracking payments, and sending reminders, making your administrative tasks easier and more efficient.

2. Regularly Update Your Records

Keep your sales ledger updated regularly to prevent the buildup of unrecorded transactions, which can lead to confusion and errors. A well-maintained ledger ensures you always have a clear picture of your financial status, which is essential for making informed business decisions.

3. Follow Up on Late Payments

With 87% of businesses experiencing late payments and over half of SMEs ending the 2022/23 tax year with unpaid invoices, it's essential to follow up promptly.

To do this, implement a systematic approach for following up on late payments. Automating this process with software can help reduce the administrative burden and improve payment times.

4. Understand Your Legal Rights

Awareness of your legal rights regarding debt recovery can empower you to take decisive action when necessary.

UK legislation allows businesses to charge statutory interest on late payments, which is 8% plus the Bank of England base rate for business transactions. This can incentivise timely payments and help compensate for the delay.

5. Regular Reviews and Audits

Periodic reviews of your sales ledger can help identify trends, such as which customers are slow payers or which products are most popular. This insight allows you to adjust your credit terms or sales strategy accordingly. Additionally, regular audits help ensure that your ledger is accurate and error-free, which is crucial for maintaining a healthy cash flow.

Final Thoughts

In the UK, SMEs consistently struggle with late payments, with small business owners collectively owed £32 billion. At any given time, 30% of these businesses are each owed up to £45,000, according to data from a 2023 report. This issue becomes particularly critical when the economy is strained, late payments can intensify the existing pressure on this already stressed sector.

Effective management of your sales ledger not only helps mitigate the impact of late payments but also supports overall business health and growth.

At Sanay, we can help you implement these tips to enhance your ability to manage finances effectively, leading to a more stable and prosperous business environment.

- Log in to post comments